tax per mile reddit

IF they were sold and IF we are to believe the 2022 S Plus 32400 - 7500 rebate at 24900 for 226 miles of EV range would put it far above the Chevy Bolt at 110 and 17 cents MSRPEPA Range. Few people volunteered for the programs initially because of privacy.

How To Join The Mile High Club Mile High Club Mile High Club

2 Car tax to be ring-fenced and actually spent on improving our roads - not just for drivers.

. For owner-operators its deducted on IRS Schedule C and directly reduces the self-employment taxes and income taxes owed on the return. 3 Practical advice for drivers from the Government around lowering carbon emissions. The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if you are self-employed.

56 cents per mile. And 10000 in expenses reduces taxes by 2730. Theyre charged 17 cents per mile and they get a bill that gives them a tax credit for paying their gas tax of 34 cents a gallon.

18 cents per mile. A driving tax proposed by President Joe Biden would cost Americans 8 cents per mile. Those miles could be racked up from meetings with clients travel to secondary work sites or errands.

We will add the 2023 mileage rates when the IRS releases them. For 2021 tax filings the self-employed can claim a 56-cent deduction per business mile driven. Pay electricity and that and taxes excise etc and youve got a pricy electric car.

A government agency shouldnt be interested in making revenue out of. The Pro version with Standard Range battery is at 181mile 149mile incl. Pennsylvania which has the highest fuel tax in the nation at 587 cents per gallon recently began discussions on whether or not an 81-cent-per-mile tax was appropriatethis would translate.

The program moving forward. The infrastructure bill includes 125 million to fund pilot programs to test a national vehicle miles traveled fee. 16 cents per mile.

585 cents per mile. This means that 545 cents or 0545 must be multiplied by the number of business miles driven to determine the amount that you deduct from the money that you earned. This totals roughly 97 in missed federal fuel taxes per vehicle each year meaning the federal government is losing out on 1746 million of revenue annually.

More efficient cars end up being nailed worse. Pennsylvania which has the highest fuel tax in the nation at 587 cents per gallon recently began discussions on whether or not an 81-cent-per-mile tax was appropriate. This gig might not be the right one for you if you cant average 1mile.

You can get a deduction for the number of business miles multiplied by the IRS mileage rate545 cents per mile as of 2018. 005 per mile would end up as a massive increase in the taxes you are paying. If you drive your car for your deliveries every mile is worth 56 cents off your taxable income the standard mileage rate for the 2021 tax year it bumps up to 585 per mile in 2022.

This is fucking bullshit. In the case of the XLT trim of the Ford F-150 Lightning the price per mile surges to roughly 240. Right now youre at 056mile.

7491 of mileage deductions 129 miles driven. When its that low youre basically working for free. 605k members in the TeslaLounge community.

Relaxed area for all-around discussion on Tesla this is the official Lounge for rTeslaMotors. Oregon and Utah launched similar pilot programs in 2015 and 2020 respectively that yielded mixed results. 206 of the 611 vehicles in Oregons pilot program that year got 22 miles per gallon.

Biden Administration Reverses Course A Second Time On Per Mile Vehicle Tax. Below are the optional standard tax deductible IRS mileage rates for the use of your car van pickup truck or panel truck for Tax Years 2007-2022. Im going to have to go out to the garage and check I thought Nissan sold 2022 LEAFs.

American drivers could soon trade paying taxes on gas at the pump for owing the government annual per-mile user fees under a new pilot program recently passed by the Senate in Joe Bidens 12. If your car gets 24 mpg now youd be paying 120 in tax based on mileage vs the 060 if paying per gallon. 8 cents per mile would be insane.

Either through increasing fuel duty or using mileage readings taken during an MOT. Medical and moving mileage. How big is the vehicle miles traveled tax.

Tax-wise I think it looks suspect to the IRS if you show a loss from a gig job. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a gasoline tax. President Joe Biden has called for a driving tax that is estimated to be 8 cents per mile.

The timing of a vote on a 12 trillion infrastructure package divided House Democrats this week. 1 A pay-per-mile road tax rewarding people for driving less. Oct 1 2021 0528 PM EDT.

The per diem is the tax-deductible amount the IRS assumes you spend on meals beverages and tips when youre away from home on an overnight business trip. The rates are categorized into Business Medical or Moving expenses and Service or Charity expenses at a currency rate of cents-per-mile. Thats 12 for income tax and 1530 in self-employment tax.

You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons. They are talking about the stagnant federal fuel tax which hasnt changed since 1993.

American Airlines Aadvantage The Ultimate Guide Forbes Advisor

Federal Mineral Royalty Disbursements To States And The Effects Of Sequestration Infographic Map Teaching Geography Historical Maps

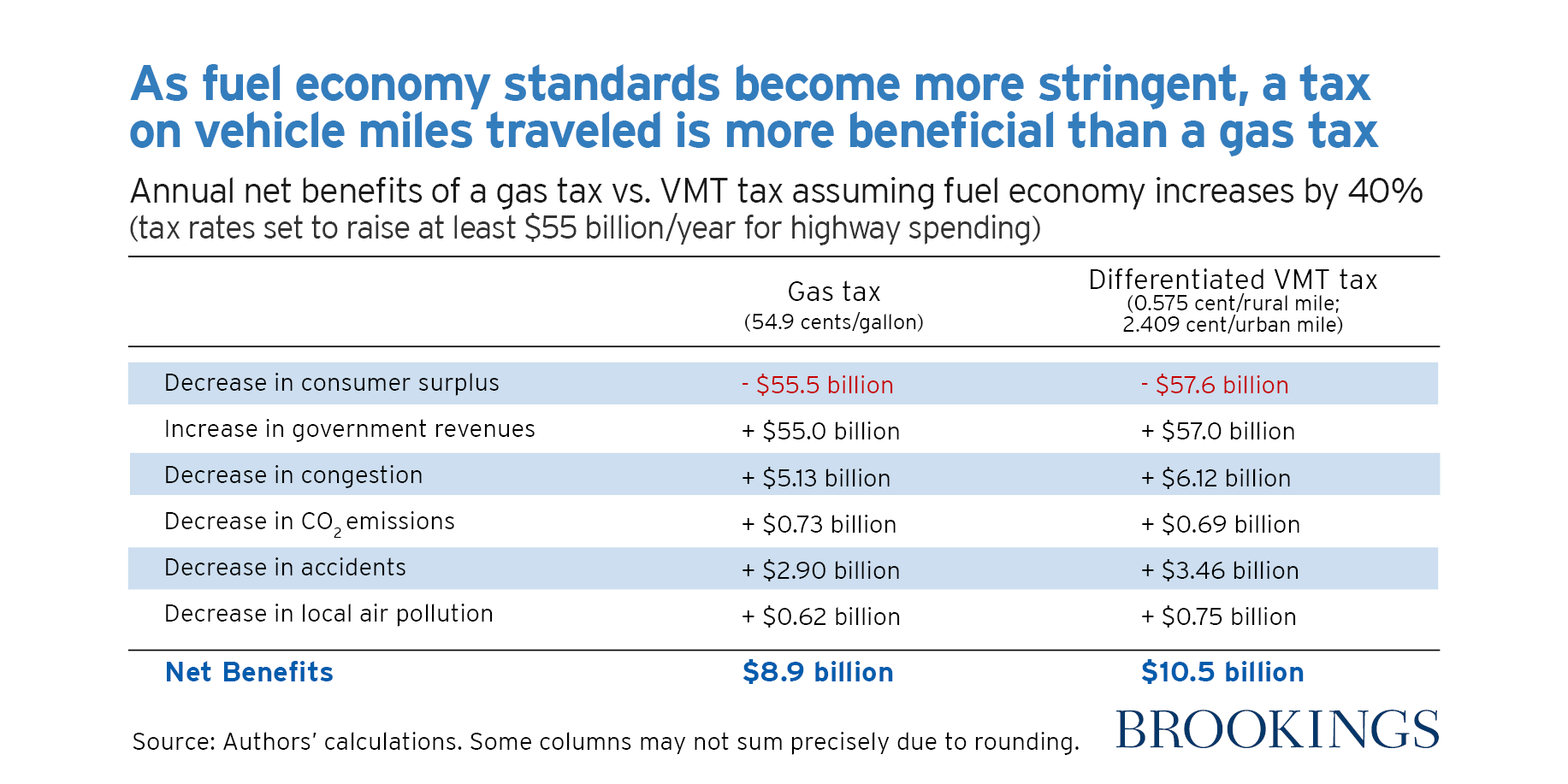

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

Pay Per Mile Tax How Would It Impact You R Ukpersonalfinance

2020 Audi R8 Decennium Carporn Audi Sports Car Audi R8 Used Audi

Drivers Face 1 000 A Year Tax For Driving To Work Under Proposed Rules Mirror Online

Irs Increases Mileage Rate To 58 5 Cents Per Mile For 2022 Grossman St Amour Cpas Pllc

Vehicle Miles Traveled Vmt Fees Study Texas A M Transportation Institute

White House Considers Vehicle Mileage Tax To Fund Infrastructure Buttigieg Says R Moderatepolitics

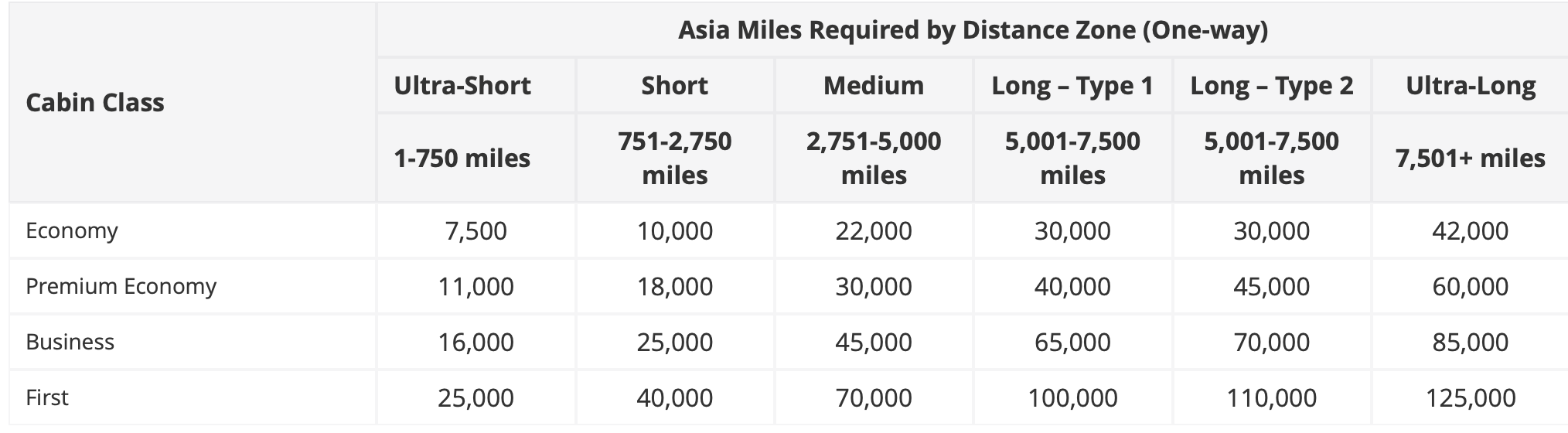

Ultimate Guide To Cathay Pacific Asia Miles The Points Guy

Also The Car Is Just Really Pretty Tesla Model Tesla Motors Tesla Model S

Editorial Biden Brings Back Road Usage Tax Plan

Paying By The Mile And Ending The Gas Tax

Infrastructure Bill Includes Per Mile Road Tax Test That Will Track Drivers Travel R Futurology

Which Evs Are Cheapest To Run Which States Is It Cheapest

Biden S New Vehicle Mileage Tax Program Will Charge Per Mile Driven Possibly Affecting Pizza Delivery Drivers Significantly R Talesfromthepizzaguy

Infrastructure Bill Includes Per Mile Road Tax Test That Will Track Drivers Travel R Futurology

Biden S New Vehicle Mileage Tax Program Will Charge Per Mile Driven Possibly Affecting Pizza Delivery Drivers Significantly R Talesfromthepizzaguy

Trucking Spreadsheet Trucking Companies Spreadsheet Trucking Business